collected by :Haron Adler

as informed in For months, analysts and investors have been debating whether a stock market whose gains have largely been driven by a handful of technology companies may be subject to a sudden reversal. Yet through much of those shock waves, the broader stock market has remained resilient. As Facebook suffered its biggest slide as a public company, dragging other technology stocks down with it, the S&P 500 slipped just 0.3%. Earnings across the rest of the stock market have been strong, buoyed by corporate tax cuts, consumer spending and an economy growing at its fastest pace in years. Ten of the 11 sectors in the S&P 500 are posting gains over the past three months.

as informed in For months, analysts and investors have been debating whether a stock market whose gains have largely been driven by a handful of technology companies may be subject to a sudden reversal. Yet through much of those shock waves, the broader stock market has remained resilient. As Facebook suffered its biggest slide as a public company, dragging other technology stocks down with it, the S&P 500 slipped just 0.3%. Earnings across the rest of the stock market have been strong, buoyed by corporate tax cuts, consumer spending and an economy growing at its fastest pace in years. Ten of the 11 sectors in the S&P 500 are posting gains over the past three months.

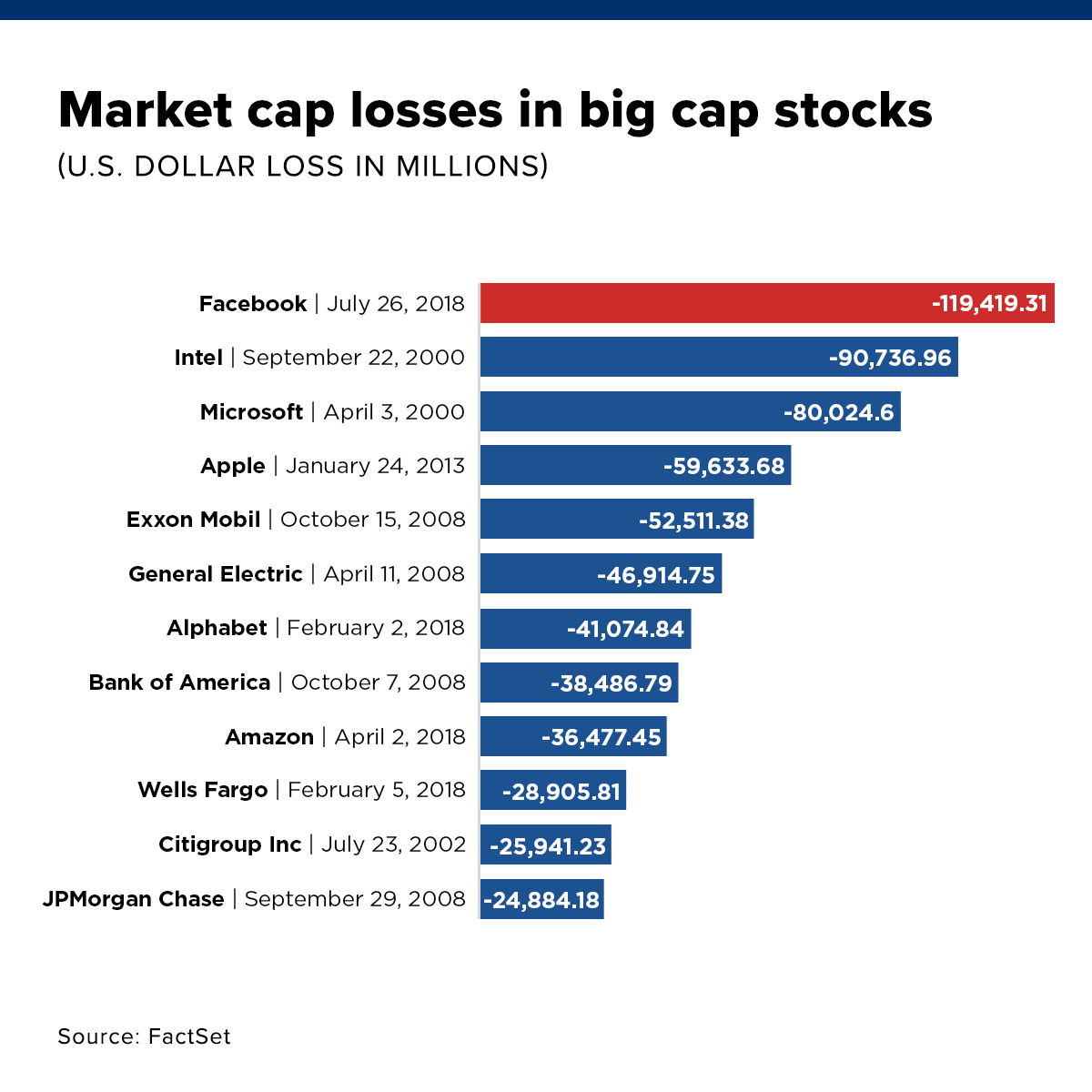

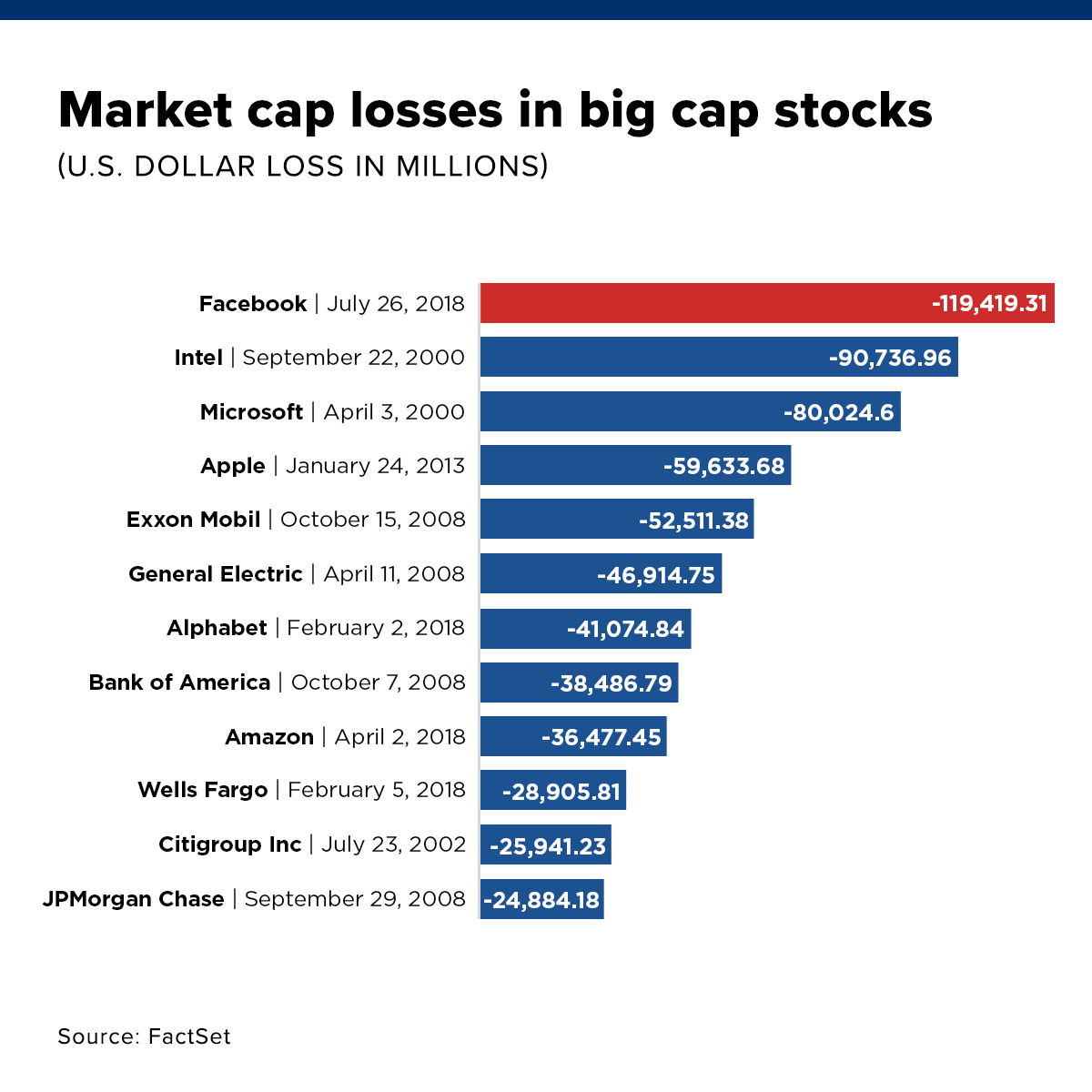

Ranking The Worst-Ever One-Day Stock Market Cap Crashes

Facebook on Thursday posted the largest one-day loss in market value by any company in U.S. stock market history after releasing a disastrous quarterly report. CNBC put together the chart below showing the Top 12 market cap crashes for individual stocks. What would happen if we adjusted the largest one-day market cap losses for these individual stocks to account for that factor? And that's covering the biggest one-day market cap crashes for individual stocks since January 2000! If we went further back in time, who knows what the real all-time one-day market cap crash champion would turn out to be!

Tenable IPO vs. Facebook's Flop: Identifying a Stock Market Trend

referring to First, there's Tenable Network Security ($TENB), the third cybersecurity firm to go public this year. Indeed, the cybersecurity market rally shows no signs of flagging. Now, the counterpoint: the collapse of Facebook's market value just a day prior to Tenable's IPO. These market trends are good news for cybersecurity firms gearing up for the next highly anticipated IPOs: CrowdStrike, Tanium, and Cylance, among them. This article first appeared in Cyber Saturday, the weekend edition of Data Sheet, Fortune's daily newsletter on the top tech news.The Stock Market Is At A Crossroads

As Larry Kudlow, the former CNBC contributor and head of the president's economic council says, "corporate profits are the mother's milk of the stock market." Higher rates are bearish because the market thinks they areEconomic expansion is a mixed blessing for the stock market which has moved higher on the back of optimism about the future. The Chinese stock market has been suffering over recent months, while the U.S. market remains near its high. I continue to favor buying volatility on the U.S. stock market during periods where it moves to the downside. The stock market is at a crossroads as the Q2 earnings season comes to an end.

Comments

Post a Comment