collected by :Haron Adler

as informed in At this point three months ago, ���market correction" and "Dow Theory" were hot button topics. However, the stock market then began its volatile slog away from the precipice, and the meaning of "tariff" morphed from global nightmare to negotiation strategy. However, if the stock market continues to meander, the downside alarms will remain primed. Downside alarm #1: Dow TheoryBecause the Dow Theory was widely discussed and analyzed in April, it is at the top of the list. The Dow Theory still labels the stock market as being in an uptrend.

as informed in At this point three months ago, ���market correction" and "Dow Theory" were hot button topics. However, the stock market then began its volatile slog away from the precipice, and the meaning of "tariff" morphed from global nightmare to negotiation strategy. However, if the stock market continues to meander, the downside alarms will remain primed. Downside alarm #1: Dow TheoryBecause the Dow Theory was widely discussed and analyzed in April, it is at the top of the list. The Dow Theory still labels the stock market as being in an uptrend.

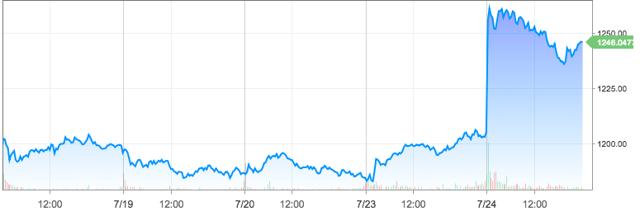

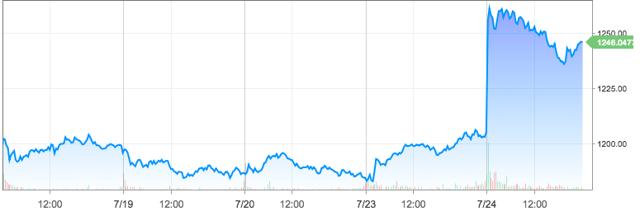

Market Volatility Bulletin: Stock Market's Google Earnings Celebration Fizzles

Market IntroCNBC: Tuesday 2:38 ESTGoogle earnings arguably gave the whole world a boost after Monday's close. Thoughts on VolatilityMost of the "most hated bull market in history", as it is frequently known, has coincided with a continued bull market in bonds (AGG). Matt Thompson reminds us that VIX essentially measures just the implied volatility on a basket of options. Which is also to say that trading VX futures is not the same as trading options on the S&P 500 (or options on VX for that matter). ConclusionIf this is your first time reading Market Volatility Bulletin, thanks for giving it a try.

Amazon's Next Mind-Blowing Achievement: $2 Trillion Stock Market Valuation

according to What Amazon said on its earnings call should have everyone imagining what Amazon's business will look like at a $2 trillion valuation. The first $1 trillion that is now coming into play was effectively created 10 years ago. Investors looking for a bottom in the stock may want to think long and hard before pulling the trigger. But aside from those things, the raw numbers for Starbucks suggest lackluster forward guidance the next time the company reports. Quick stats from the quarter: (1) Fiscal-year earnings guidance tapered to $2.40 a share to $2.42 a share.A Stock Market Crash With Chinese Characteristics

The last time Chinese stocks popped, in early 2015, was a classic example of Chinese market dysfunction. The bull market in Chinese stocks, which started in 2016, had better fundamental economic support—but that support is now eroding. An investor watches stock prices at a brokerage in Beijing on July 6. More cash trapped in China chasing fewer empty houses raises the probability of a less severe Chinese housing downturn this time around. AdvertisementA stock market crash—so far much smaller than in 2015—is something China can likely handle.

Comments

Post a Comment